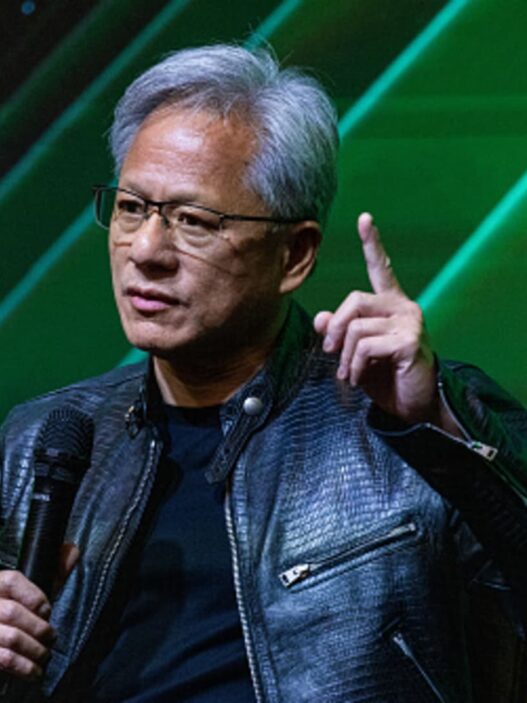

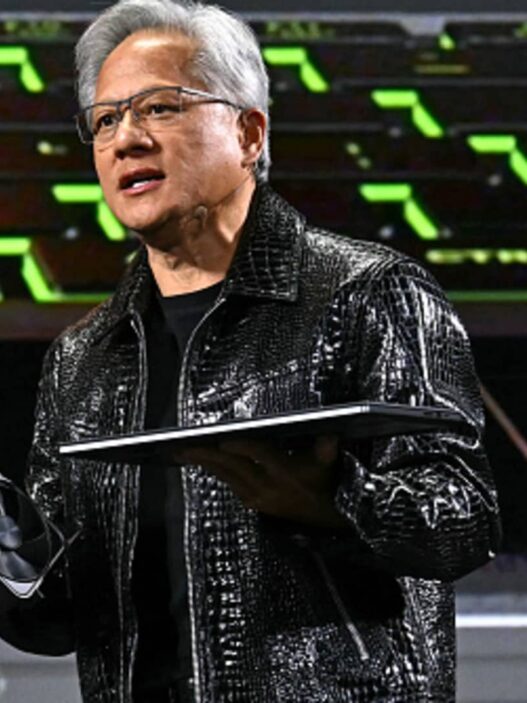

Each weekday, CNBC’s Investment Club with Jim Cramer Livestream holds a “Morning Meeting” at 10:20 a.m. ET. Here’s a recap of Monday’s key moments. 1. Stocks plugged on Monday as Chinese AI model Deepseek sent shockwaves through the tech sector. Semiconductor stocks led the decline with NVIDIA and Broadcom down 13%. Investors fear it may be too safe to spend on AI as Deepseek appears to show that you may be able to build competitive language models without using expensive chips. Jim Cramer said the latest news leaves more questions than answers. “I don’t think we can necessarily reach a conclusion about what to do.” 2. Jim sees a potential opportunity in Broadcom’s chip stock. “If there was to be a buyout, it would actually be Broadcom…it’s bigger than just AI.” He expects this is the name the market could rally behind instead of Nvidia because the company’s portfolio also includes networking solutions and infrastructure software. We recently reduced our position on December 17 after the stock went parabolic following its fourth earnings call. Meanwhile, it’s dead on our radar for an ornament. With shares up 12% to start 2025 and up 65% over the past year, Jim warned that “it’s pretty high against the rest of the MAG 7 stocks,” adding that the tech giant could spend a lot on building AI. Meta announced on Friday that it plans to increase AI-related spending to as much as $65 billion this year. 3. Salesforce was easing the selloff with shares up 2.4%. Jim described the company as a “beneficiary” of all the worry about DeBsec. CEO Marc Benioff sees the value of AI in making software, not hardware. Apple is holding its ground as well, with its shares up 2.5%. The iPhone maker is not investing billions of dollars in large language models, but instead integrating technology from other companies like Openai’s chatgpt into its devices. (Jim Cramer’s charitable fund is Long NVDA, Avgo, Meta, CRM. See here for a full list of stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after a trade alert is sent before buying or selling a stock in the Trust’s portfolio. If Jim talks about a stock on CNBC TV, he waits 72 hours after the trade alert is issued before executing the trade. The above Investment Club information is subject to our Terms and Conditions and Privacy Policy, together with our Disclaimer. No fiduciary obligation or duty exists, or is created, by virtue of your receipt of any information provided in connection with the Investment Club. There is no specific result or guaranteed profit.

Home Cramer was tempted to buy the chip maker, selling Hyperscaler on Deepseek Sell-Off – usa365.news