Chinese AI startup DeepSeek has stunned the world with the release of its R1 model, which seems to be performing well. Almost so Leading models from Google and OpenAI, though the company claims to have used a relatively modest number of GPUs to train them.

DeepSeek’s relative efficiency has experts and investors wondering whether AI really needs the massive hardware outlay that everyone expected. This may change the demand for data centers and the energy required to operate them

The company claims to have run 2,048 Nvidia H800 GPUs for two months to train a slightly older model, which is a fraction of the computing OpenAI is rumored to be using.

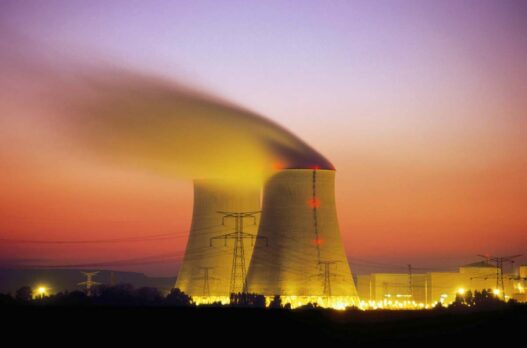

Few companies are as vulnerable as Nvidia, whose stock price is down 16% at press time. Perhaps startups and energy producers that are betting big on new nuclear and natural gas capabilities are most at risk.

Nuclear power, in particular, has been on the cusp of a renaissance for many years, driven by advances in fuel and reactor designs that promise to make a new generation of power plants safer and cheaper to build and operate. So far, there has been no good reason to move forward. Nuclear power is still expensive compared to wind, solar, and natural gas. In addition, the next generation of nuclear weapons has not yet been tested on a commercial scale.

The surge in energy demand from artificial intelligence has changed the equation. With data centers expected to consume up to 12% of total US electricity — more than tripling their share in 2023 — and AI data centers expected to double by 2027, technology companies are racing to secure new supplies, throwing billions of dollars at the table. Google has pledged to buy 500 megawatts of power from nuclear energy startup Kairos, Amazon has led a $500 million investment in another nuclear startup, X-Energy, and Microsoft is working with Constellation Energy to renovate a reactor at Three Mile Island worth $1.6 million. Billion dollars.

But what if the problem is exaggerated?

There is no hard and fast rule that says the only way to improve AI performance is to use more computing. For a while, this tactic worked well, but recently, more computing has not yielded the same results. AI researchers have been looking for solutions, and DeepSeek has likely found a solution for its R1 model.

Not everyone is convinced, of course.

“While DeepSeek’s achievement may be groundbreaking, we question the idea that its accomplishments were accomplished without the use of advanced GPUs,” Citigroup analyst Atif Malik wrote.

However, history suggests that even if DeepSeek is hiding something, someone else will likely find a way to make AI cheaper and more efficient. After all, it is easier and perhaps faster to assign a few PhDs to develop better models than to build new power plants.

The current wave of new reactors is not scheduled to start operating until 2030, and new natural gas power plants will not be available until the end of the decade at the earliest. In this context, energy investments made by technology companies appear to serve as hedges in case their software bets do not pan out.

If they do, expect tech companies to scale back their energy ambitions. When technology companies have a choice between spending billions on physical assets or software, they almost always choose the latter.

Where does that leave nuclear startups and energy companies? It depends. Some may be able to produce energy at a low enough cost that it won’t matter if the AI’s energy needs to be diminished. The world is full of electricity, and even before the AI bubble started inflating, so was the demand for electricity It is expected to grow.

But in the absence of demand from AI, cost pressures are likely to increase. Wind, solar and battery power are cheap, growing, and are inherently modular and mass-produced. Developers can roll out new renewable energy plants in phases, delivering electricity (and revenue) before the entire project is completed, while providing some control over their future in the face of uncertain demand. The same cannot be said for a nuclear reactor or gas turbine. Technology companies know this, which is why they have been quietly investing in renewable energy sources to power their data centers.

Few people predicted the current AI boom, and it is unlikely that anyone knows how things will play out in the next five years. As a result, the safest bets in energy are likely to flow to proven technologies that can be quickly deployed and scaled according to a rapidly evolving market. Today, renewable energy sources fit this bill.